child tax portal not working

Have been a US. Bruenig alongside web designer Jon White recently created their own version of a child tax credit portal for non-filers to demonstrate how it should actually function.

Irs Child Tax Credit Open To Unenroll And Check Eligibility

Making a new claim for Child Tax Credit.

. Get your advance payments total and number of qualifying children in your online account. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. This year Americans were only required to file taxes if they.

The Child Tax Credit Update Portal now issues a warning in bold. These payments up to 300 per month per child under age 6 and up to 250 per month per child age 6 through 17 will be paid in equal amounts and made no earlier than. The amount you can get depends on how many children youve got and whether youre.

Up to 3600 300 monthly per qualifying dependent child under 6. Making a new claim for. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

Other Tools and Portal Enhancements. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you. Not everyone is required to file taxes.

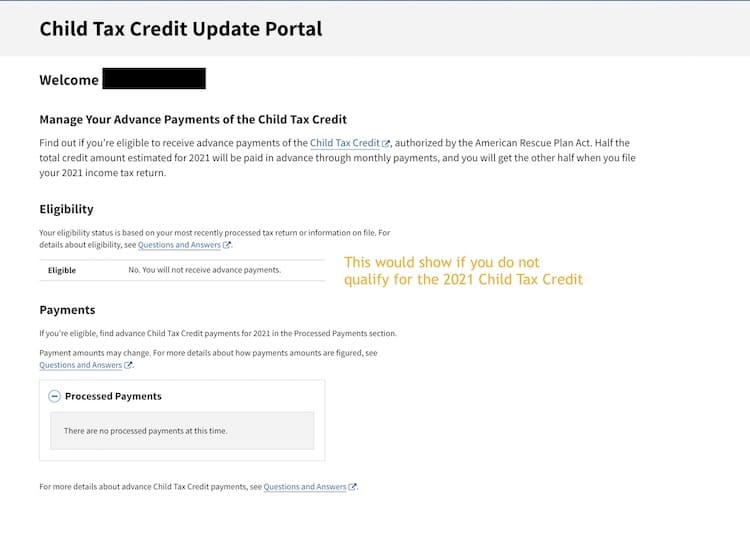

Keep reading to learn more about the child tax credit portal update. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. The Child Tax Credit Update Portal is no longer available.

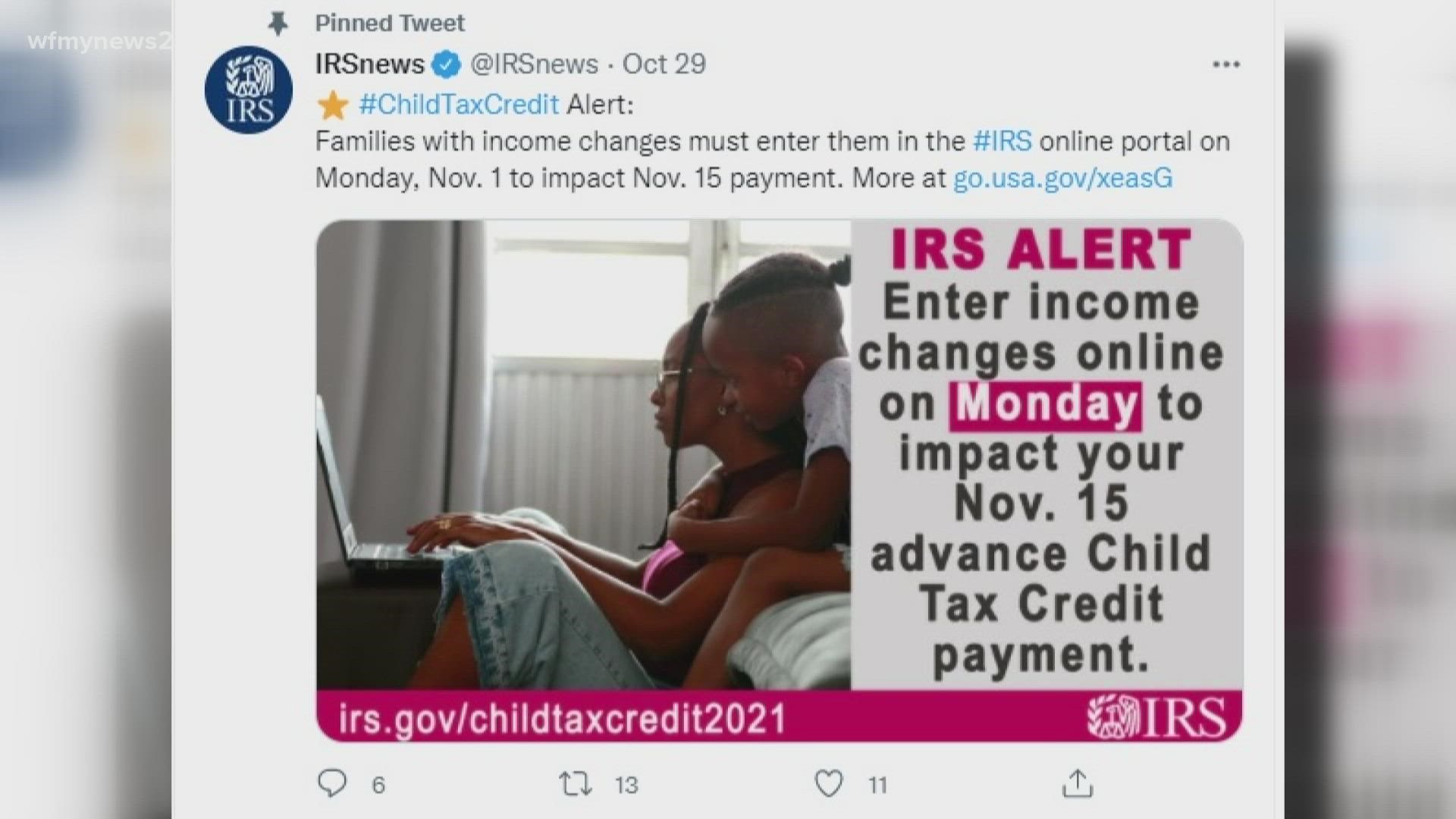

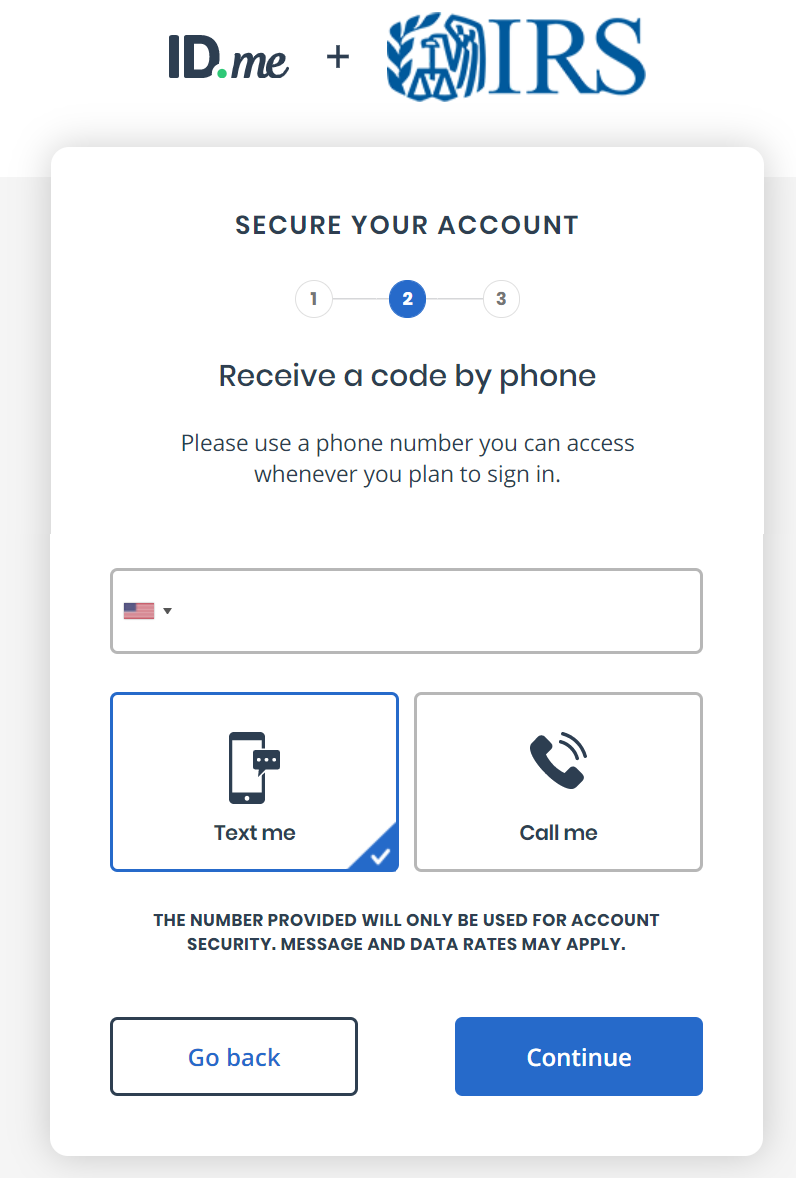

The advance payments are half of the total so the couple will receive 500 250 per dependent each month. You will be sent a code through these apps to verify its you. The up-to-date information will be available Monday the IRS said in a fact sheet that it posted Friday.

Starting Monday January 31 find the Advance Child Tax Credit payment. The advance payments are half of the total so the couple will. Already claiming Child Tax Credit.

The IRS will pay 3600 per child to parents of young children up to age five. Do not use the Child Tax Credit Update Portal for tax filing information. What is the Non-Filer Sign Up Tool.

If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a couple of things. It has gone from 2000 per child in 2020 to 3600 for each child under. You can use your username and password for the Child Tax Credit Update Portal to.

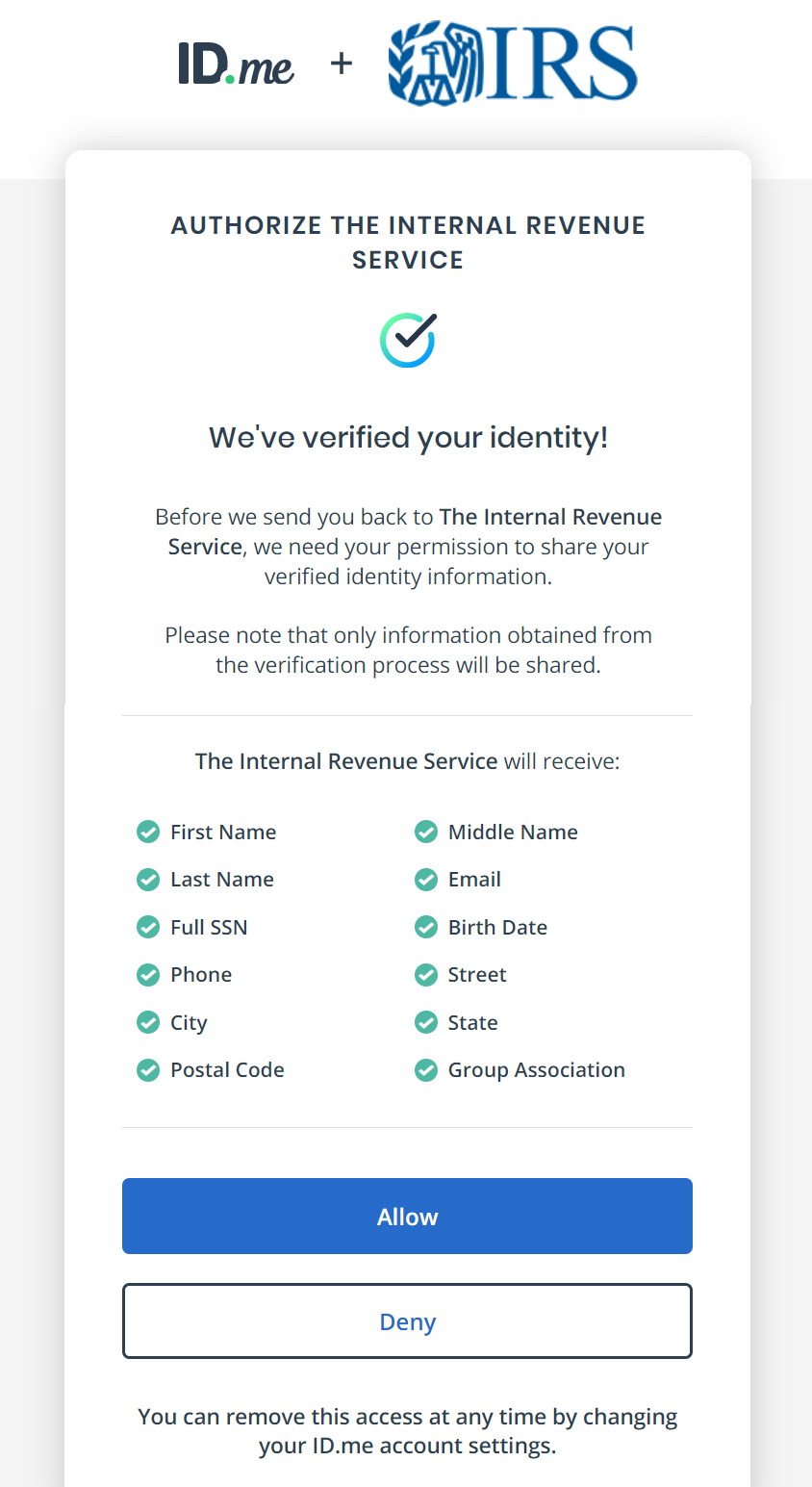

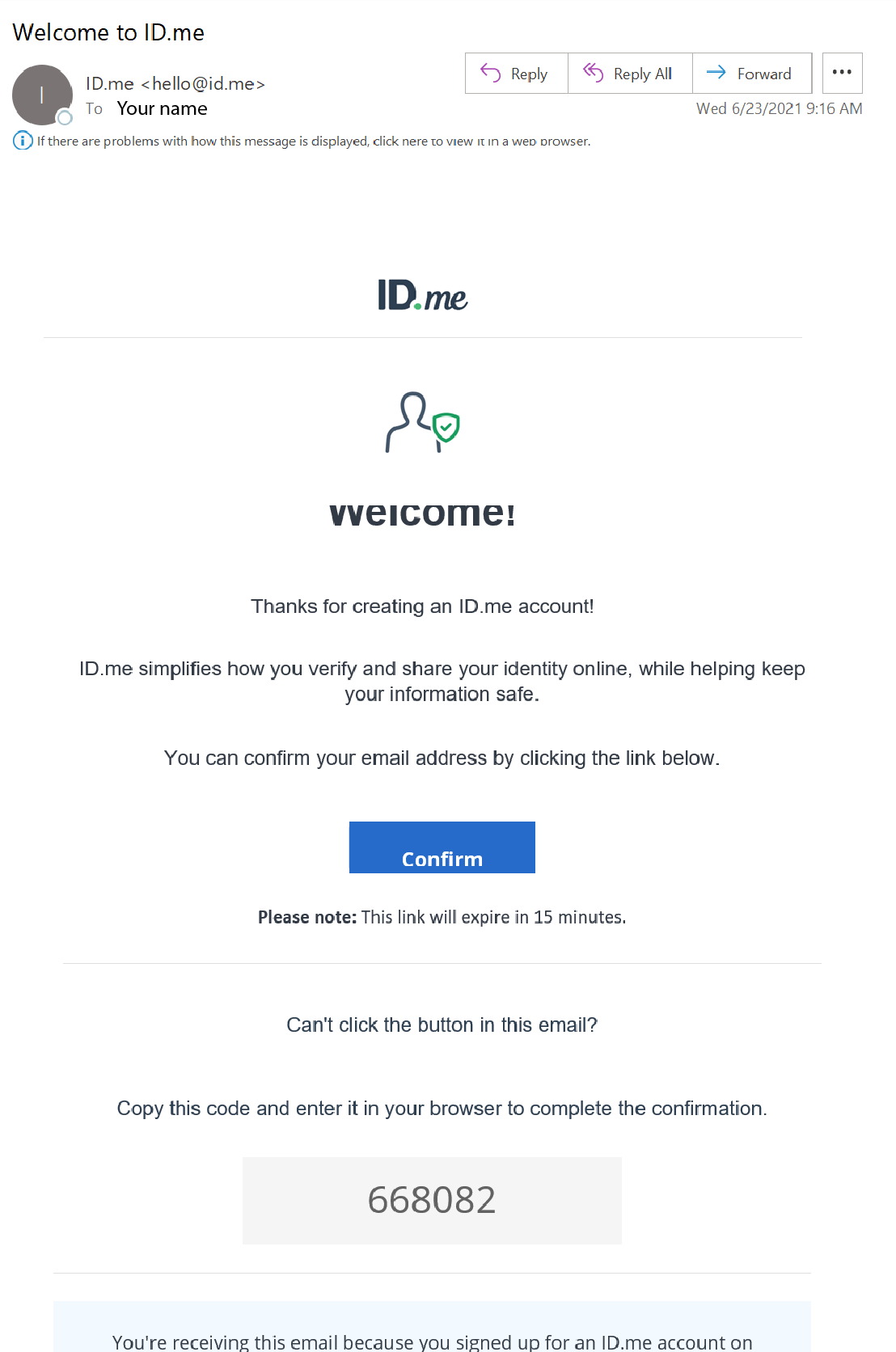

Resident alien You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. First things first you will need to download the IDme application on your smartphone or tablet. Heres what you can do in the IRS Child Tax Credit Portal English Español Updated on 72121 June 25 2021 The Child Tax Credit Update Portal allows you to verify your familys.

Half of the money will come as six monthly payments and half as a 2021 tax credit. Its called the Non-filer sign-up tool which is for people who did NOT. Already claiming Child Tax Credit.

This year Americans were only required to file taxes if they. Child tax credit portal not working.

Online Portal Ensures All Who Qualify Can Get Child Tax Credit 12newsnow Com

Didn T Get Your Child Tax Credit Here S How To Track It Down

Child Tax Credit Cport Credit Union

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Steps To Take To Receive Or Manage

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Irsnews On Twitter Families Receiving Monthly Childtaxcredit Payments Can Now Update Their Direct Deposit Information Using The Irs Child Tax Credit Update Portal Available Only On Https T Co Kcgzufn9b4 Https T Co 86p0nfcgv1 Https T Co

Irs Deadline Nears To Make Final Changes To Last Child Tax Credit Payment Of The Year Weareiowa Com

Irs Deadline To Change Your Child Tax Credit Information Wfmynews2 Com

Irs Child Tax Credit Portal Open For Parents Who Want To Opt Out Of The Monthly Payments 5newsonline Com

Families To Start Receiving Child Tax Credit Checks Here S How To Register Defer Or Un Enroll Osceola News Gazette

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

Spanish Version Of Irs Child Tax Portal Now Available King5 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Change Address On Child Tax Credit Update Portal Taxing Subjects

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Parents Can Claim Up To 300 In Child Tax Credit For Kids 17 And Under From July 15 Here S How To Apply The Us Sun